Financial Information

“As a business, we’re not risk averse. We take on big projects for big corporations and achieve big outcomes.”

Sir Peter Rigby, Chairman and Founder

Highlights

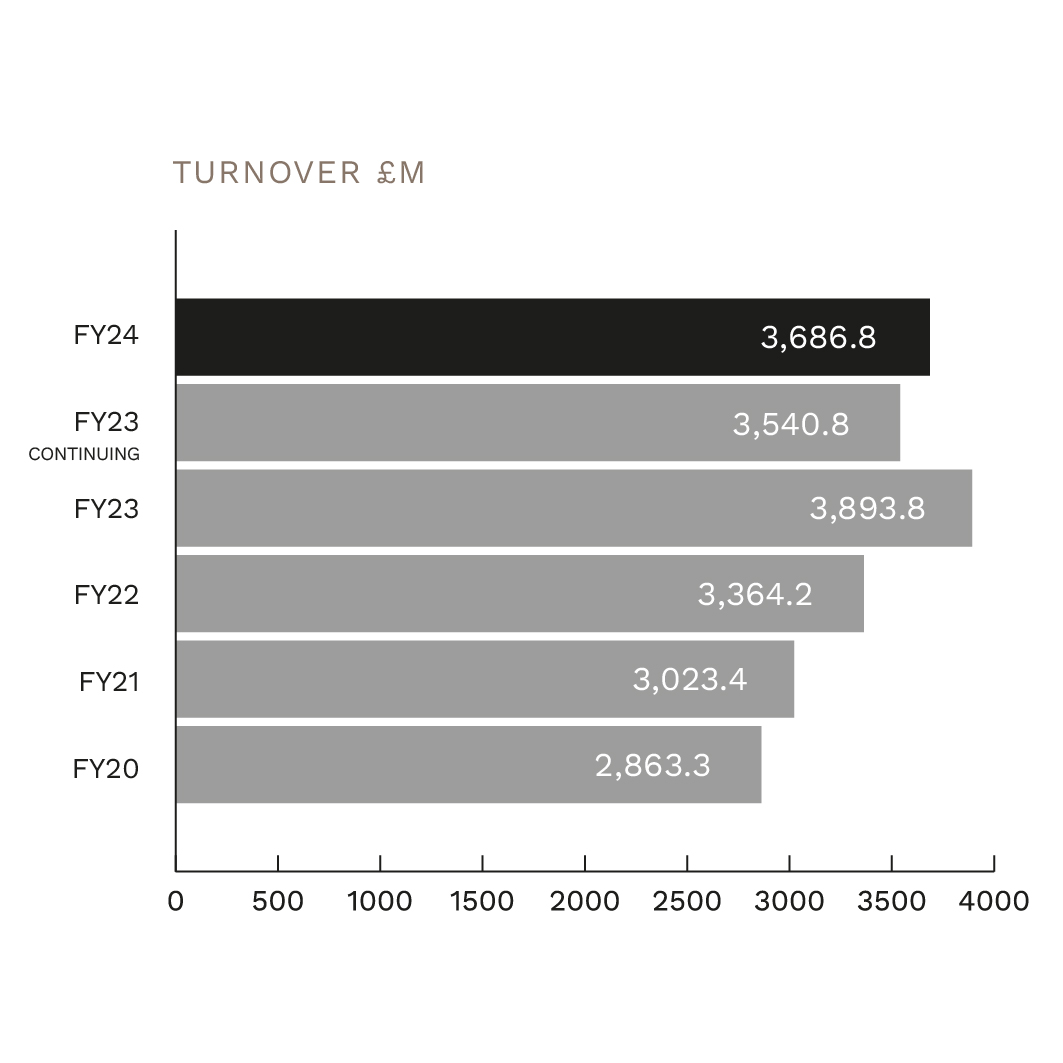

Group Turnover

£3.7bn

-5%

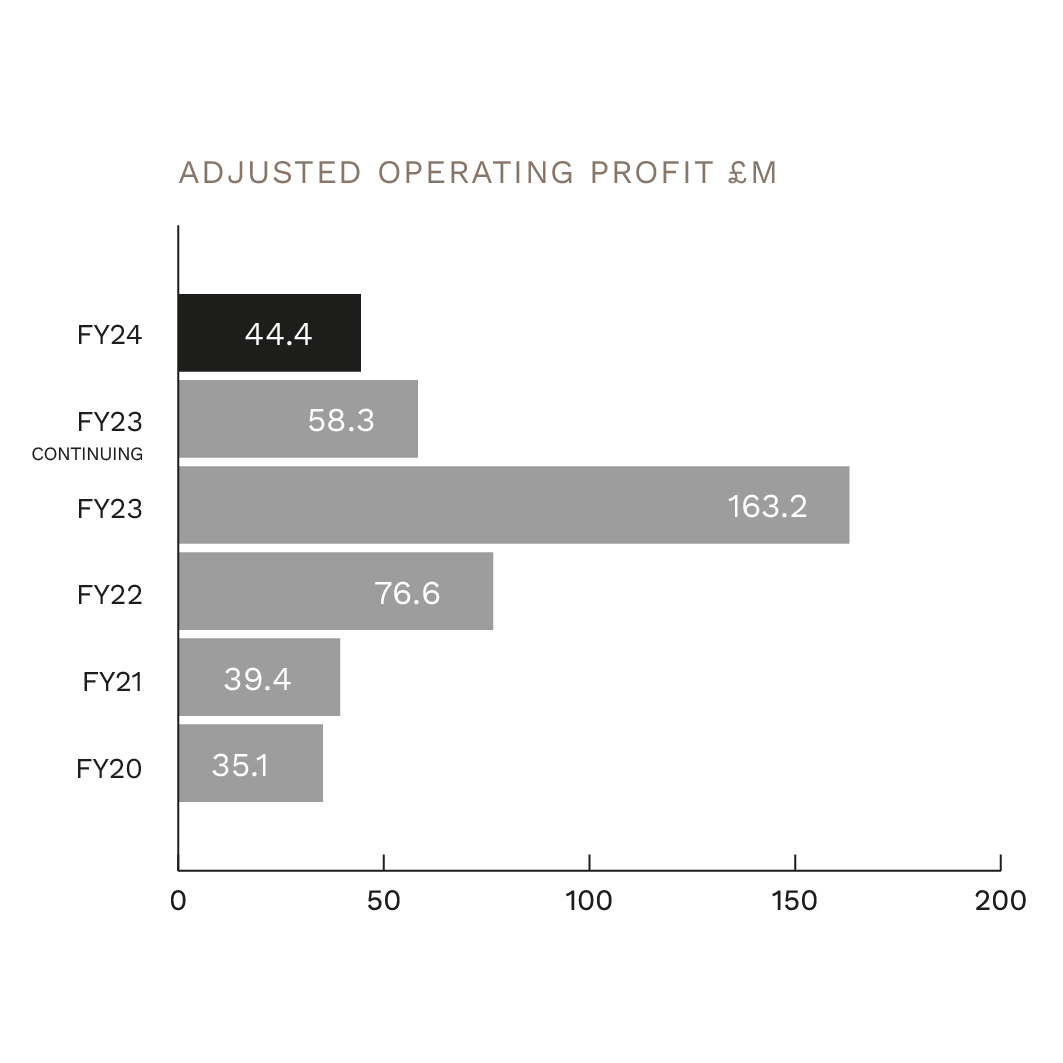

Adjusted Operating Profit (continuing)

£44.4m

-24%

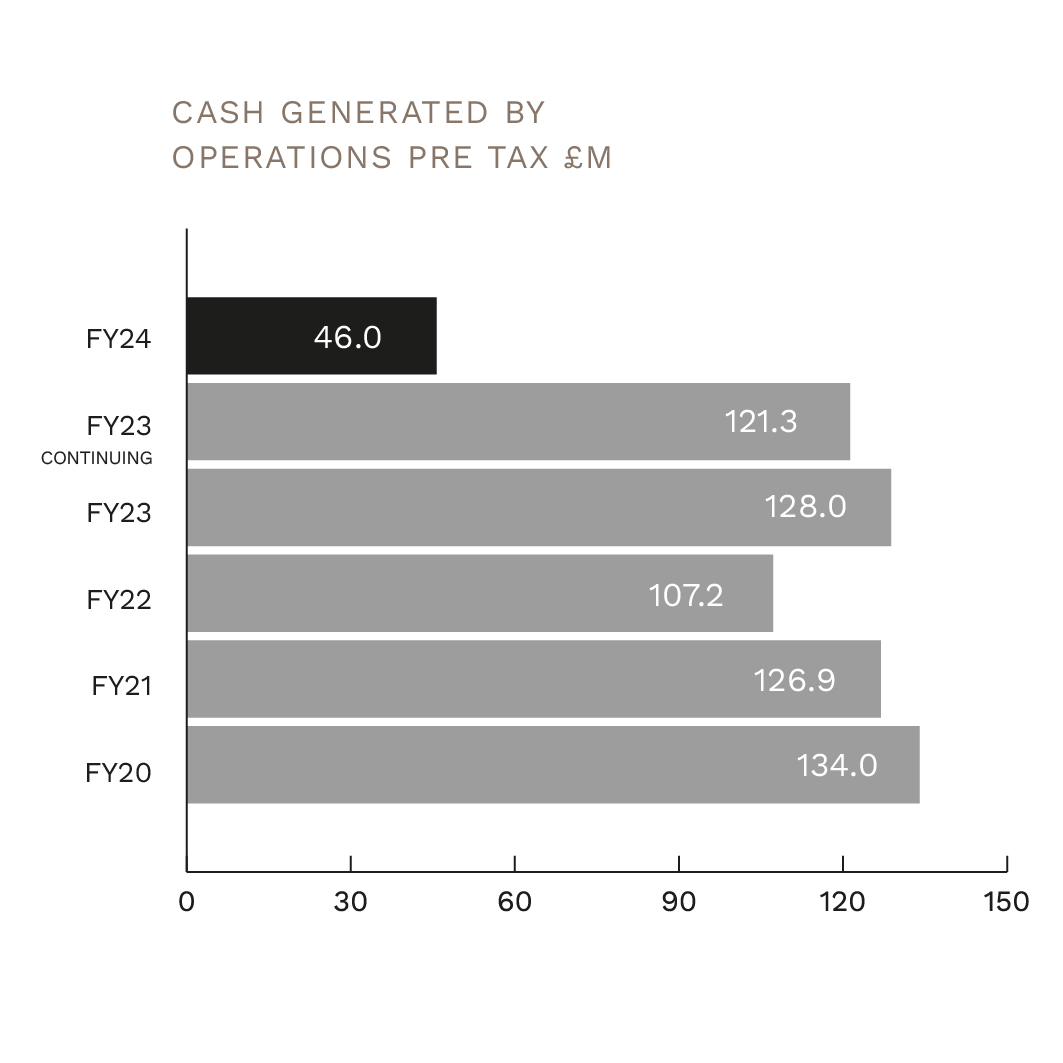

Cash Generated by Operations

£46.0m

-64%

Adjusted Profit

£70.0m

-64%

Cash Resources

£477.6m

-12%

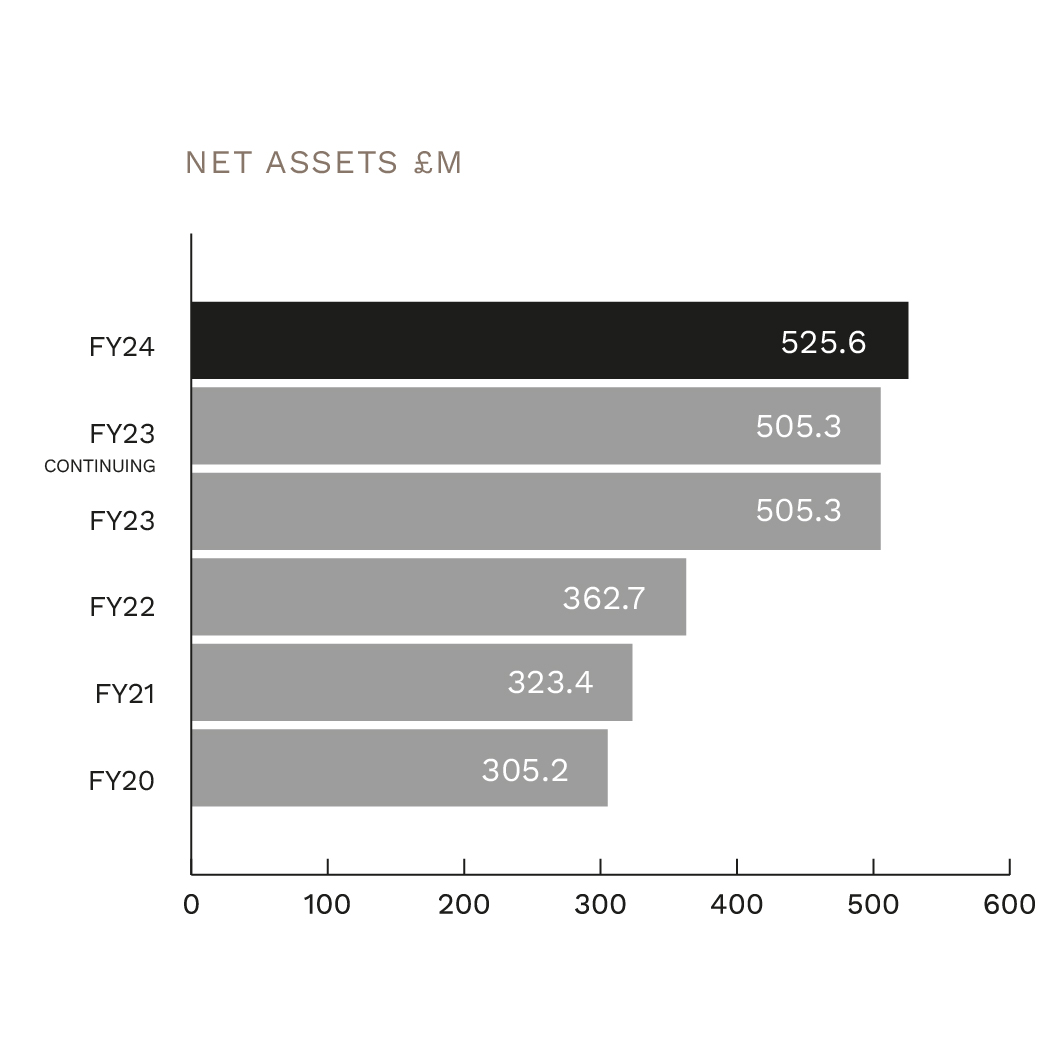

Net Assets

£525.6m

+4%

CFO's Statement FY23

FY2024 was a year of growth for Rigby Group’s core businesses and investment in the future. Strong profitability from the Group’s cornerstone business SCC’s French operations and its airports division (RCA) was balanced against the adverse technology market and economic conditions experienced in the UK.

Headline group revenues of £3,686.8m declined by 5%. After excluding the £352m of revenues from the discontinued businesses sold in the prior year, underlying revenues were 4% higher. Turnover in all divisions increased except for that of the Rigby Technology Investments (RTI) division where our Unified Communications business, Nuvias, declined by 28%.

Technology is the cornerstone of Rigby Group, with SCC continuing as the principal driver of growth as the Group seeks to create long-term value as a technology-focused business operator and investor.

Elsewhere, our Airport division, RCA the UK’s leading regional passenger and cargo group, reported their best-ever performance, growing by 20%. At Bournemouth Airport, passenger numbers rose 21%, exceeding pre-pandemic numbers and it is currently one of the fastest growing UK airports.

CFO Peter Whitfield, CFO

Read more +METRICS

“We are proud to be in the Top 10 wholly owned family businesses in the UK and part of the 500 largest family businesses globally. FY2024 was a year of growth In our core businesses and investment in the future.”

Steve Rigby, CO-CEO Rigby Group

Divisional Performance

TECHNOLOGY

TURNOVER 2024

£3.4bn

+5%

FY23 £3.2bn

OPERATING PROFIT 2024

£37.2m

-46%

FY23 £68.9m

TURNOVER 2024

£92.0m

-17%

FY23 £110.3m

OPERATING LOSS 2023

£(5.8)m

-4%

FY23 £(5.6)m

Real Estate

AIRPORTS

2024

TURNOVER

£112.6M +20%

FY23 £94.0M

OPERATING PROFIT

£16.2M +459%

FY23 £2.9M

COMMERCIAL REAL ESTATE

2024

TURNOVER

£3.7M +16%

FY23 £3.2M

OPERATING PROFIT

£8.0M +371%

FY23 £1.7M

HOTELS

2024

TURNOVER

£17.1M +2%

FY23 £16.7M

OPERATING LOSS

£(2.9)M -26%

FY23 £(2.3)M

RESIDENTIAL REAL ESTATE

2024

TURNOVER

£22M -33%

FY23 £32.8M

OPERATING PROFIT

£0.5M +67%

FY23 £0.3M

Please note: above financial results for Residential Real Estate are not listed separately within Rigby Group’s Annual Report 2024, they are grouped within Commercial Real Estate.